August 11th, 2025

Buying a home is one of the most significant financial decisions most people will ever make, yet it's a process fraught with potential pitfalls. The good news? By learning from the common mistakes others have made, you can sidestep unnecessary stress, save money, and make more informed decisions.

A knowledgeable homebuyer is a confident homebuyer, and understanding these 12 common missteps can empower you to navigate the process smoothly and successfully. Whether you're a first-time buyer or a seasoned homeowner, this insight can make all the difference in ensuring your experience is a positive one.

Not Knowing Your Budget - Many homebuyers start searching for homes without understanding how much they can afford, leading to disappointment when they find out their price range is lower than expected.

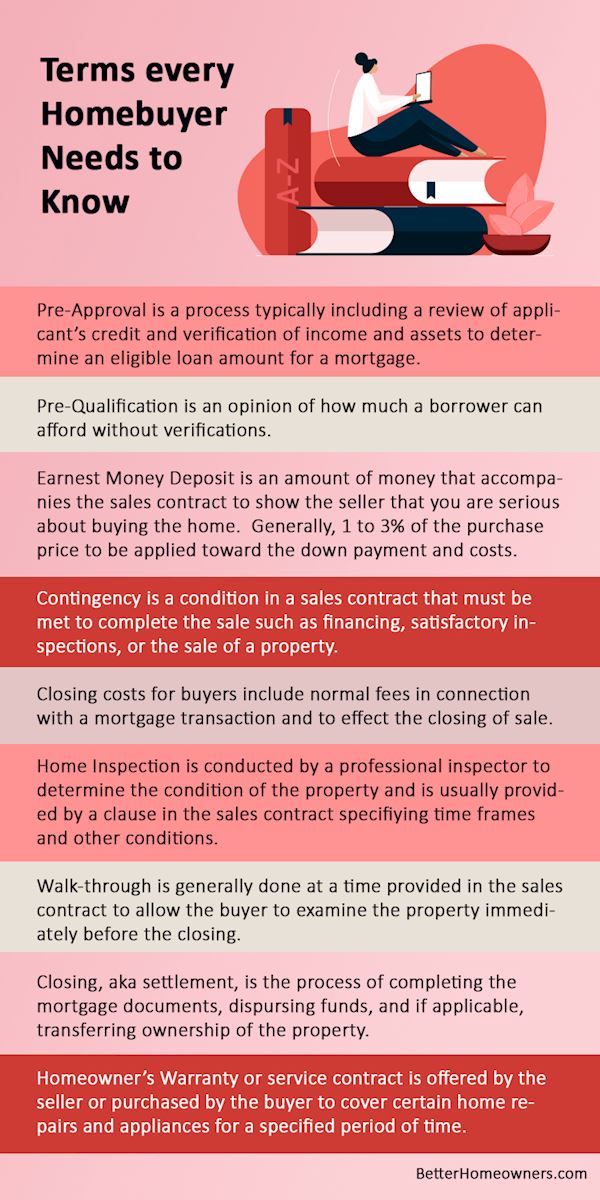

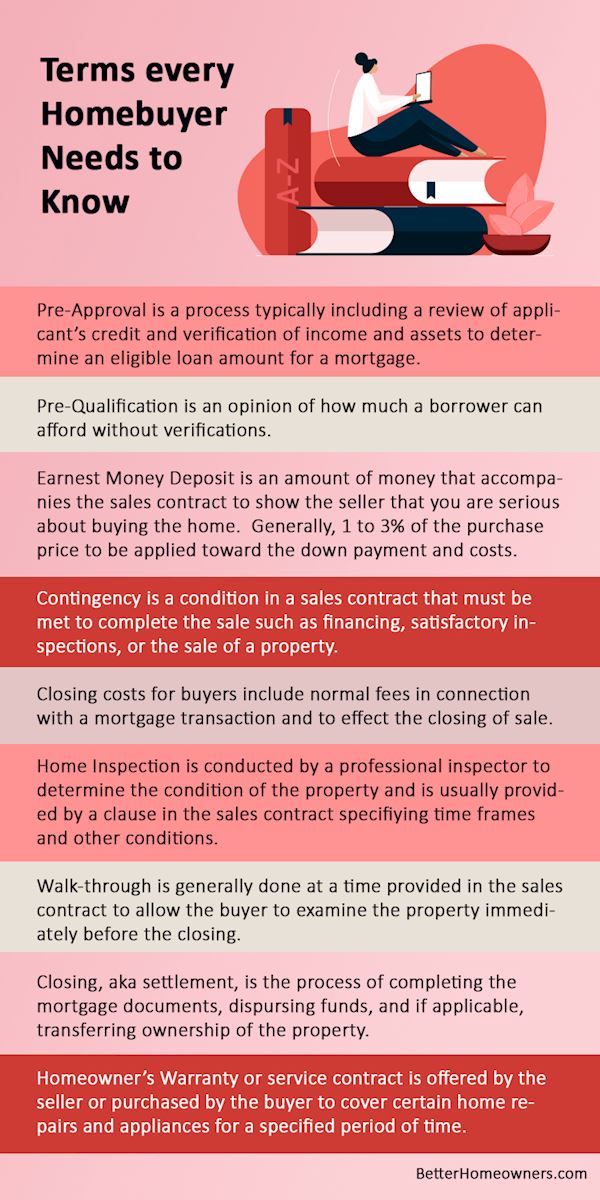

Skipping Mortgage Pre-Approval - Failing to get pre-approved for a mortgage can result in missed opportunities or delays, as it shows sellers that you are a serious buyer and helps you understand your financial limits.

Ignoring Additional Costs - Homebuyers often underestimate ongoing costs such as property taxes, homeowner's insurance, utilities, and maintenance, which can significantly impact their budget.

Rushing the Process - Moving too quickly can lead to poor decisions, such as making an offer without thoroughly evaluating the property or neighborhood.

Not Researching the Neighborhood - Buyers sometimes overlook the importance of researching neighborhoods, which can affect their long-term satisfaction and property value.

Making Emotional Decisions - Allowing emotions to drive decisions can lead to overpaying for a home or ignoring potential red flags during the buying process.

Underestimating Repair and Renovation Costs - Many buyers fail to accurately assess the costs of necessary repairs or renovations, often influenced by unrealistic portrayals in media.

Not Conducting a Home Inspection - Skipping a professional inspection can lead to unexpected repair costs after purchase, as buyers may overlook significant issues.

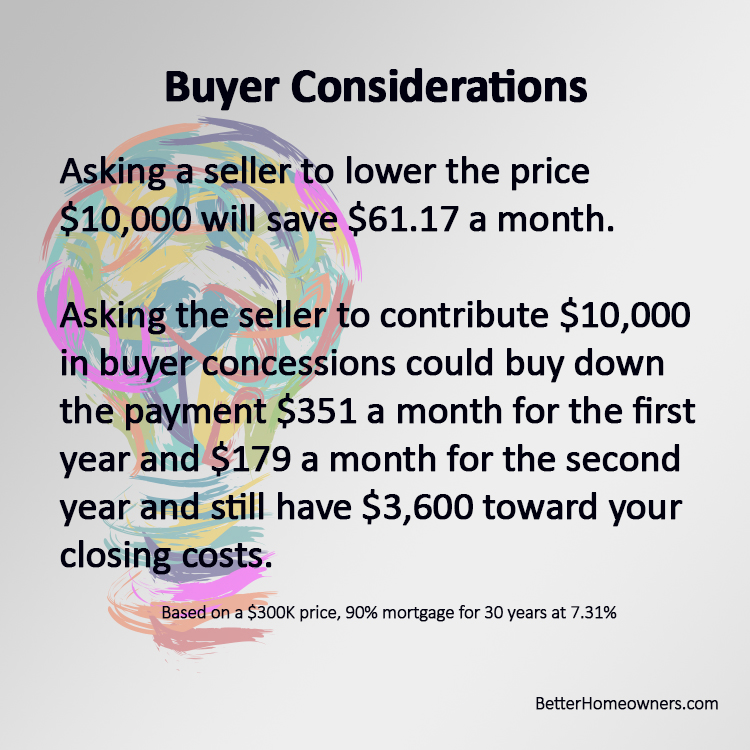

Failing to Negotiate - First-time buyers often hesitate to negotiate on price or terms, missing out on potential savings or favorable conditions.

Spending All Savings on Down Payment - Buyers sometimes use most of their savings for a down payment, leaving little for emergencies or unexpected expenses after moving in.

Not Considering Resale Value - Focusing solely on immediate needs without considering future resale value can lead to regret if circumstances change.

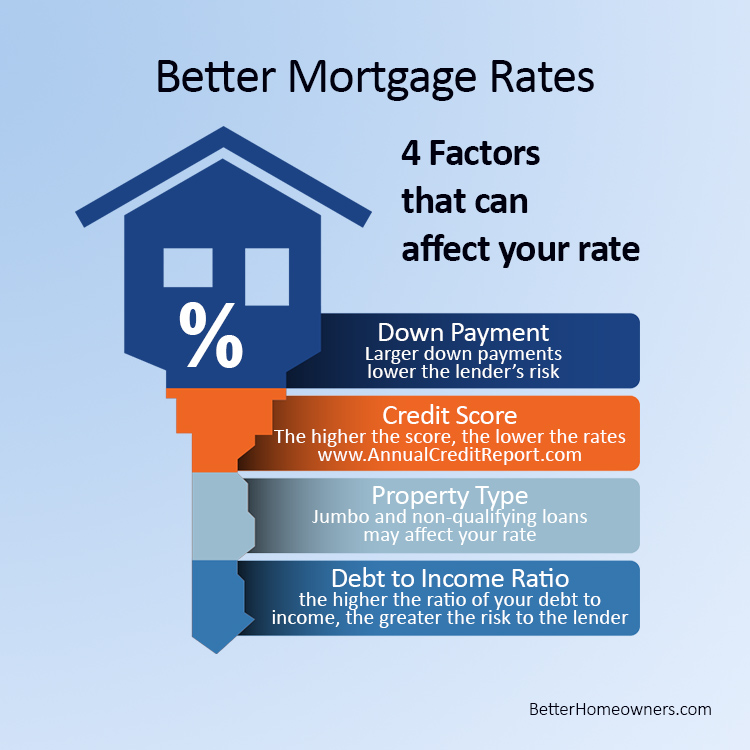

Getting Only One Loan Quote - Many buyers apply for a mortgage with only one lender, potentially missing out on better rates and terms available from other lenders.

Avoiding common homebuying mistakes starts with preparation and the right guidance. By understanding these 12 pitfalls and taking proactive steps to address them, you can make your homebuying journey smoother, more productive, and ultimately more enjoyable.

One of the best ways to ensure success is to schedule an early appointment with your buyer's agent. A knowledgeable agent can help you navigate potential challenges, provide expert advice, and tailor the process to meet your unique needs. With the right partner by your side, you'll be well-equipped to avoid these mistakes and move confidently toward finding your perfect home.

Download our complimentary Buyers Guide.

July 7th, 2025

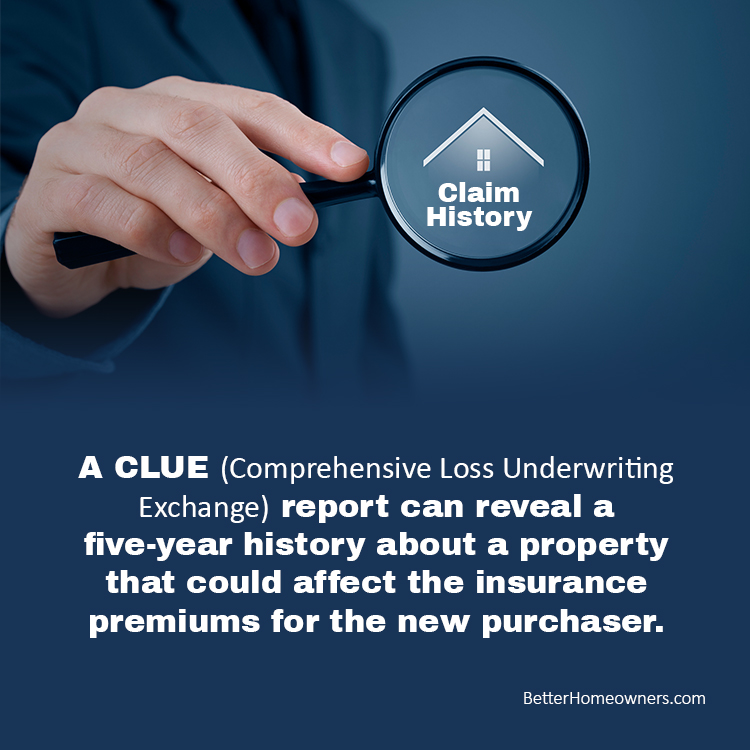

When selling a home, full transparency is key. Seller disclosures provide potential buyers with crucial information about the condition of the property, ensuring a fair and informed transaction. Understanding what must be disclosed and why it matters can help protect both buyers and sellers from unexpected issues down the road.

Seller disclosures are legal documents that outline any material defects in the property such as issues that could negatively impact its value or safety. While specific disclosure requirements vary by state and local law, common disclosures include:

- Past or present structural defects

- Completed repairs or renovations

- Natural hazards (flood zones, earthquake risks, etc.)

- HOA rules and restrictions

- Land-use limitations

- Missing essential systems or features

- Prior property damage

- Any known deaths on the property (where required by law)

Seller disclosures are important and serve a dual purpose:

- For Buyers: They help potential buyers assess the property's condition before making an offer, reducing the likelihood of surprises after closing.

- For Sellers: Providing full and accurate disclosures can help protect sellers from legal liability. By documenting known issues upfront, sellers reduce the risk of future disputes that could lead to costly lawsuits.

Most states require sellers to complete a Seller Disclosure Form or Property Disclosure Statement. These standardized documents vary in detail, with some states mandating extensive disclosures while others allow sellers to disclose conservatively. Your agent will guide you in completing the form accurately.

The exact defects that require disclosure depend on state regulations, but common items include:

- Foundation issues or structural damage

- Plumbing or electrical problems

- Appliances not working properly

- Roof leaks or aging systems

- Pest infestations

- Environmental hazards (mold, asbestos, radon)

While not mandatory, sellers may choose to conduct a pre-listing home inspection to identify potential red flags before listing. Addressing repairs in advance can increase buyer confidence and potentially lead to stronger offers.

If no material defects exist, a seller can state this on the disclosure form. However, if there's any uncertainty, it's always best to disclose. Failing to do so could lead to legal repercussions if an issue arises after closing.

In most states, disclosures must be presented before a buyer signs a binding contract. Some sellers opt to disclose earlier, such as during showings or open houses, to establish trust and set buyer expectations. Your agent can confirm the appropriate timing based on local regulations.

Withholding required disclosures can result in serious consequences, including:

- A buyer canceling the sale

- Legal action against the seller

- Financial damages or required repairs at the seller's expense

Honesty and transparency are the best policies when it comes to seller disclosures.

Seller disclosures are a vital part of the home-selling process, offering protection for both buyers and sellers. If you're preparing to sell, work closely with your real estate professional to ensure you meet all legal requirements. By providing full and accurate disclosures, you can foster buyer confidence, avoid legal issues, and facilitate a smoother home sale.

For guidance on navigating seller disclosures, contact your trusted real estate professional today!

06/23/2025

In today's digital world, protecting your online information is more important than ever. You likely have multiple accounts...email, banking, investments, and social media...all of which need strong, unique passwords. Trying to create and remember complex passwords for each site can be overwhelming. That's where a password manager comes in.

A password manager is a secure app that stores and generates strong, unique passwords for all your online accounts. Instead of struggling to remember dozens of complicated passwords, you only need to remember one master password.

Here's why using a password manager is one of the smartest security moves you can make:

- Stronger Passwords - Password managers generate complex passwords using a mix of letters, numbers, and symbols. These are much harder to crack than passwords people typically create on their own. With a password manager, you won't have to worry about using weak or repetitive passwords.

- Unique Passwords for Every Account - Using the same password across multiple sites is a major security risk—if one account is compromised, hackers could gain access to all your accounts. A password manager eliminates this risk by creating a different, strong password for each website or app you use.

- Easy Access and Management - With a password manager, logging into your accounts is quick and hassle-free. Instead of typing in passwords or trying to reset them when you forget, the password manager automatically fills them in for you. This makes accessing important tools—like your CRM, email, and transaction software—both secure and convenient.

- Secure Storage - Reputable password managers use strong encryption to protect your passwords. Even if the company storing them were to be hacked, your passwords remain encrypted and secure. This level of protection is far stronger than writing passwords in a notebook or saving them in a document on your computer.

Best Practices for Using a Password Manager - To maximize the security benefits of a password manager, keep these best practices in mind:

- Choose a trusted password manager ... Look for one with a strong track record of security, such as 1Password, LastPass, or Bitwarden.

- Protect your master password ... Since this is the key to all your other passwords, make sure it's long, unique, and never shared.

- Enable two-factor authentication (2FA) ... Whenever possible, add an extra layer of security by enabling 2FA for your password manager and other important accounts.

Stay Secure in the Digital Age

As a real estate professional, you handle sensitive client information daily. Using a password manager is an easy yet powerful way to keep your accounts secure and protect your business from cyber threats.

If you're fully embedded in Google's ecosystem and follow strong security practices, Google Password Manager is a convenient and secure option. However, if you need cross-platform flexibility, enhanced encryption controls, or additional security features, a dedicated password manager like 1Password or Bitwarden may be a better choice.

Taking this simple step will give you peace of mind, allowing you to focus on what matters most...helping your clients buy and sell homes with confidence.

June 6th, 2025

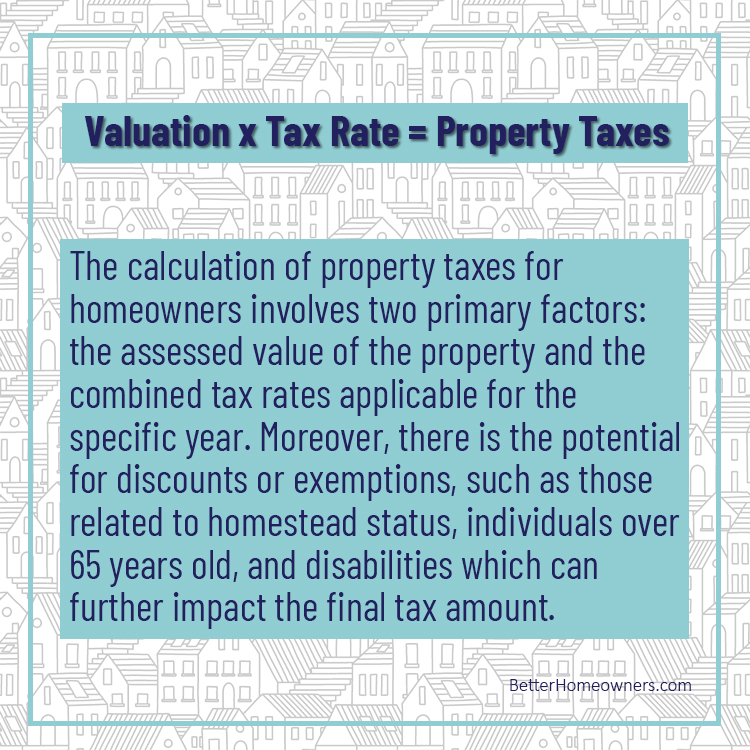

Benjamin Franklin famously stated that "in this world, nothing is certain except death and taxes." While his words still ring true, there's another unavoidable reality in modern life: rising costs. From groceries to energy bills, the cost of living continues to climb, and one of the biggest contributors to this is housing.

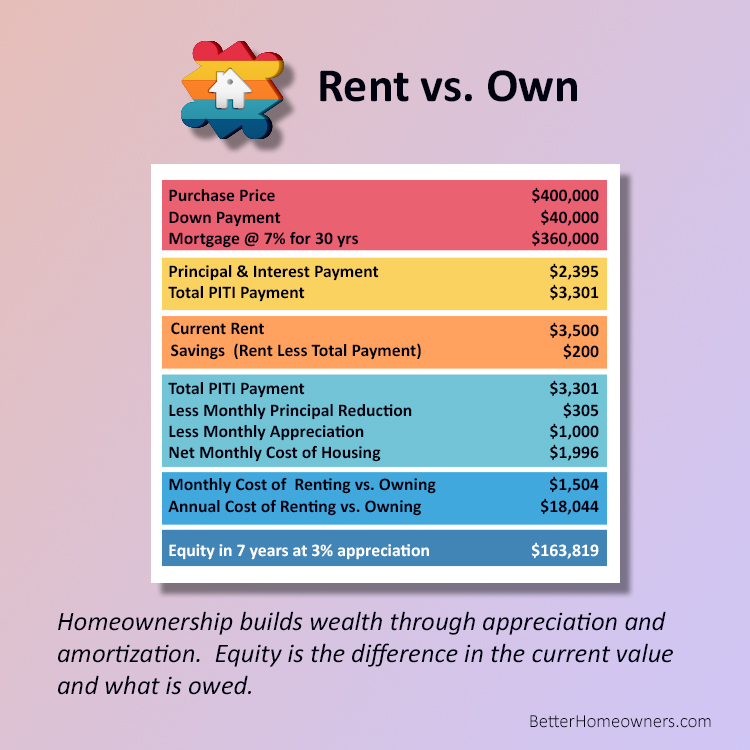

Housing has always been a major expense for individuals and families, but recent data highlights just how burdensome it can be. According to an article released in September 2024, renters spent a median of 31.0% of their income on housing costs, while homeowners with a mortgage spent 21.1%, and those without a mortgage spent just 11.5%. Despite this, 18.8 million homeowners were still dedicating more than 30% of their income to housing expenses, illustrating that affordability remains a challenge for many.

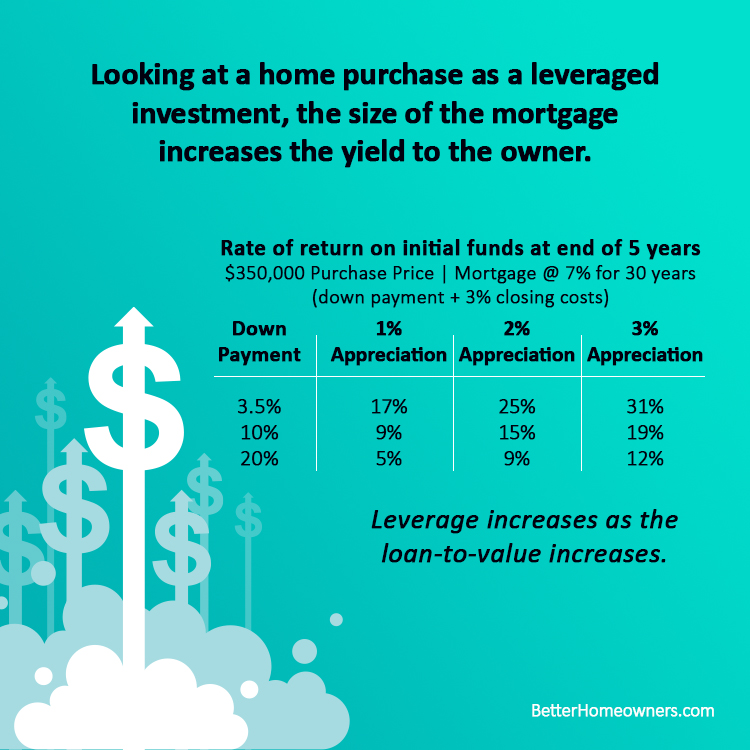

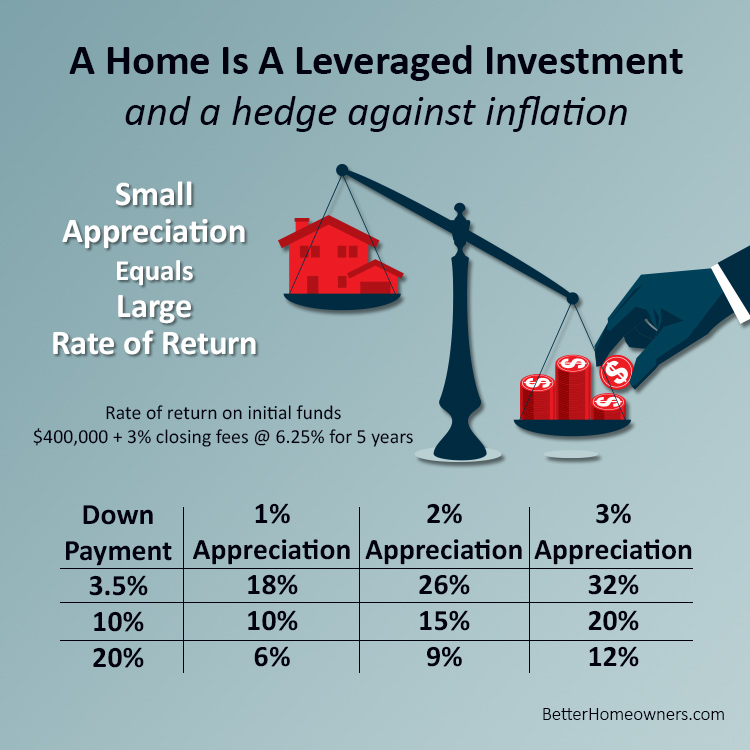

The long-term trends in housing costs are equally telling. According to the Federal Reserve Economic Data, rent increases have averaged 3.88% annually over the past 60 years, outpacing the average inflation rate of 3.7% during the same period. Meanwhile, the median home has appreciated at an average annual rate of 5.56%, showing that homeownership not only shields against rising rents but also builds wealth over time.

The financial benefits of homeownership extend far beyond escaping annual rent hikes. The latest Federal Reserve Board Survey of Consumer Finance reveals that median homeowners have 38 times the household wealth of renters. This wealth disparity underscores the power of owning a tangible asset like a home, which appreciates in value and provides stability in a world of ever-increasing costs.

While rising home prices and higher mortgage rates may deter some from entering the housing market, it's important to consider the long-term financial advantages of homeownership. Waiting on the sidelines, hoping for prices or rates to drop significantly, could mean missing out on years of equity growth and continued rent hikes.

A significant factor influencing today's housing decisions is mortgage rates. The historically low rates seen before the pandemic were an anomaly, not the norm. The 52-year Freddie Mac average for 30-year fixed-rate mortgages is 7.74%, which is much closer to the rates we're seeing today. For prospective buyers, accepting the current rates as the "new normal" is key to moving forward and securing the long-term benefits of homeownership.

While some individuals are genuinely priced out of the housing market, many are financially capable of purchasing a home but are hesitant due to uncertainty. However, delaying a purchase means continuing to pay rising rents and missing out on the wealth-building potential of owning a home. Even at current rates, the long-term advantages of homeownership—including equity growth, tax benefits, and protection against inflation—far outweigh the costs of waiting.

Death, taxes, and rising costs are life's unavoidable truths, but how you navigate them can shape your financial future. Housing represents one of the most significant expenses for individuals and choosing to own rather than rent can make a profound difference in wealth accumulation and financial security.

While mortgage rates and home prices may feel intimidating, they reflect a long-term norm rather than an exception. For those who can afford to buy now, stepping into the market could be the key to securing stability and wealth in an uncertain world. Don't let hesitation hold you back from building a solid foundation for your future.

Download the Homeowners Tax Guide.

May 27th, 2025

As experienced real estate investors reach the limits of conventional financing options, creative approaches become essential for continued portfolio growth. Here are eight innovative financing strategies to help you expand your rental property investments beyond traditional boundaries:

House Hacking offers a clever entry point for investors looking to maximize their purchasing power. By utilizing owner-occupied loans like FHA or VA, you can secure a property with minimal down payment and favorable terms. The strategy involves living in the property initially, then transitioning it to a rental once you've met occupancy requirements. This approach not only provides a cost-effective way to acquire property but also allows you to gain hands-on landlord experience while building equity.

Seller Financing presents a flexible alternative to traditional mortgages. By negotiating directly with the property owner, you can often secure more favorable terms, including lower down payments and interest rates. This method can be particularly advantageous when dealing with motivated sellers or in markets where conventional financing is challenging. Seller financing agreements can be tailored to suit both parties, potentially offering a win-win situation for buyer and seller alike.

Portfolio Loans cater specifically to real estate investors, especially those managing multiple properties. Unlike conventional loans sold on the secondary market, portfolio lenders retain these loans in-house, allowing for more flexible underwriting criteria. This can be particularly beneficial for investors with complex financial situations or those seeking to finance properties that don't meet standard lending guidelines. Portfolio loans often consider the overall strength of your investment portfolio rather than focusing solely on individual property metrics.

Private Money Lending taps into the resources of individual investors or small groups willing to fund your real estate purchases. These arrangements often offer faster approval and closing processes compared to traditional lenders. While interest rates may be higher, the speed and flexibility of private money can be invaluable in competitive markets or for time-sensitive deals. Cultivating relationships with private lenders can provide a reliable source of capital for future investments.

The BRRRR Strategy (Buy, Rehab, Rent, Refinance, Repeat) is a powerful method for building a rental portfolio with limited capital. This approach involves purchasing distressed properties at below-market prices, renovating to increase value, renting to establish cash flow, then refinancing to extract equity for the next investment. The BRRRR method allows investors to recycle their initial capital, potentially growing their portfolio faster than with traditional buy-and-hold strategies.

Cross Collateralization leverages equity from properties you already own as collateral for new loans. This strategy can significantly reduce the need for large cash down payments on new acquisitions. By using existing equity, investors can expand their portfolios more rapidly. However, it's crucial to carefully consider the risks, as multiple properties may be at stake if financial difficulties arise.

Hard Money Loans provide short-term financing options ideal for quick purchases or properties requiring significant renovation. While these loans typically come with higher interest rates, they offer rapid approval and closing processes, which can be crucial in competitive markets. Hard money lenders focus primarily on the property's potential value rather than the borrower's creditworthiness, making them an attractive option for deals that might not qualify for conventional financing.

Partnerships and Joint Ventures allow investors to combine resources and expertise. By teaming up with other investors, you can pool capital, share risks, and leverage complementary skills. This approach can be particularly effective for larger or more complex investments that might be out of reach for individual investors. Clear agreements outlining roles, responsibilities, and profit-sharing are essential for successful partnerships.

As you explore these creative financing options, remember that each strategy carries its own set of risks and rewards. Careful due diligence, thorough financial analysis, and possibly consultation with legal and financial professionals are crucial steps in determining the best approach for your investment goals and circumstances.

Download our Rental Investment information guide.

May 19th, 2025

Maintaining a clean and organized home is essential for creating a comfortable and welcoming living space. Whether you're preparing to sell your home or simply want to enjoy a clutter-free environment, taking time to declutter and deep clean can work wonders.

Not only does it help you stay organized, but it also enhances the functionality and aesthetics of your space. This article provides a comprehensive checklist of tasks to guide you through decluttering and deep cleaning your home, ensuring every corner sparkles and feels refreshed.

Decluttering Tasks:

- Start Small: Begin with one room, drawer, or closet to avoid feeling overwhelmed.

- Create Keep, Donate, and Discard Piles: Sort items into these categories to streamline the process.

- Purge Expired or Unused Items:

- Check kitchen pantries for expired food.

- Sort through toiletries and medications for expired products.

- Organize Closets:

- Donate clothes you haven't worn in the past year.

- Use matching hangers for a neater look.

- Store out-of-season clothing in labeled bins.

- Streamline Paper Clutter:

- Shred old bills and unnecessary documents.

- Create a filing system for important papers.

- Declutter Drawers and Cabinets:

- Discard duplicate or broken kitchen gadgets.

- Organize junk drawers with dividers.

- Sort Toys and Games:

- Donate items that are no longer used.

- Organize with clear bins or labeled containers.

- Clear Out the Garage or Basement:

- Dispose of old tools, paint cans, or unused equipment.

- Use shelving to keep the floor clear.

- Minimize Decorations:

- Reduce the number of knick-knacks or personal items to create a cleaner look.

- Store sentimental items in labeled boxes.

Deep Cleaning Tasks:

- Clean Windows and Mirrors:

- Wash inside and out for a streak-free shine.

- Dust and clean windowsills and tracks.

- Dust Everything:

- Wipe down baseboards, crown molding, and ceiling fans.

- Clean vents and light fixtures.

- Vacuum and Shampoo Carpets: Focus on high-traffic areas and spot-treat stains.

- Clean and Polish Hard Floors:

- Sweep, mop, and polish wood or tile floors.

- Use grout cleaner for tiled surfaces.

- Scrub Bathrooms:

- Clean toilets, sinks, bathtubs, and showers thoroughly.

- Remove hard water stains and reseal grout if necessary.

- Deep Clean the Kitchen:

- Degrease oven hoods, stovetops, and backsplashes.

- Empty and clean the refrigerator and freezer.

- Sanitize countertops and clean cabinet faces.

- Refresh Upholstery and Curtains:

- Vacuum furniture and wash removable cushion covers.

- Launder or dry-clean curtains and drapes.

- Eliminate Dust in Hidden Areas:

- Clean under beds, behind appliances, and in corners.

- Wash Walls and Doors: Wipe down scuff marks and fingerprints.

- Deodorize and Freshen Up:

- Use air purifiers or natural remedies like baking soda to eliminate odors.

- Open windows for fresh air circulation.

Finishing Touches:

- Add Greenery: Place a few indoor plants to create a refreshed and vibrant look.

- Rotate Seasonal Décor: Keep displays relevant and minimal.

- Organize Entryways: Create a clutter-free, welcoming first impression with tidy shoe racks and coat hooks.

- Maintain a Cleaning Schedule: Regular upkeep can prevent the need for major decluttering sessions in the future.

A decluttered and deeply cleaned home doesn't just look better—it feels better too. By following this checklist, you'll create a space that's more functional, relaxing, and inviting for yourself and your loved ones. Whether you're tackling these tasks in one weekend or spreading them out over time, the effort will be well worth it.

Remember, maintaining a clean and organized home is an ongoing journey, so consider integrating some of these tips into your routine. Here's to a home that brings you joy and peace of mind!

May 7th,2025

Real estate transactions often involve significant sums of money, making them a prime target for sophisticated wire fraud schemes. Buyers, especially those preparing for closing, should be aware of these scams and take proactive measures to protect their hard-earned funds. Here's how the scam typically unfolds and how to avoid becoming a victim.

How Wire Fraud Schemes Work

Scammers usually begin by gaining unauthorized access to the email accounts which is often achieved through phishing emails that trick recipients into sharing login credentials. Once inside, scammers monitor email exchanges to gather information about pending transactions, including closing dates, amounts due, and parties involved.

As the closing date approaches, the scammers strike. They send an email to the buyer, posing as a trusted party in the transaction. The email includes updated wire transfer instructions, directing the buyer to send funds to an account controlled by the scammer. These emails often appear legitimate, complete with real names, logos, and details specific to the transaction. To add pressure, scammers may emphasize urgency, warning that delays could jeopardize the closing.

If the buyer follows the fraudulent instructions, the funds are transferred to the scammer's account?often overseas?making recovery extremely difficult, if not impossible.

How to Protect Yourself

While these scams are sophisticated, buyers can take several steps to safeguard their funds:

- Verify Wire Instructions: Always verify wire transfer instructions by calling the title company or attorney using a known, trusted phone number. Never rely on contact information provided in an email.

- Be Cautious with Email Communication: Avoid sending sensitive information, such as financial details, through email. Many real estate professionals offer secure communication portals?use them whenever possible.

- Watch for Red Flags: Be suspicious of any last-minute changes to payment instructions or emails containing grammatical errors, typos, or unfamiliar sender addresses. Authentic emails from trusted parties will match their established communication style.

- Confirm the Transaction: After wiring funds, contact the recipient immediately to confirm that the payment was received in the correct account.

Stay Vigilant

Wire fraud is a growing threat in real estate transactions, but awareness and caution can significantly reduce your risk. If something feels off, take the time to double-check before acting.

By remaining vigilant and verifying all instructions, buyers can protect themselves from devastating financial losses and ensure a smooth path to closing on their dream home. Your agent can be helpful in verifying if the request is legitimate.

April 14th, 2025

Selling a home in today's market requires more than just listing it...you need to meet buyers where they are. With home prices at record highs and mortgage rates around 6.5%, many buyers simply don't have the funds left for renovations or repairs after closing. That's why preparing your home before listing is crucial to achieving the best possible price, a quick sale, and a smooth transaction.

One of the biggest benefits of preparing your home is financial. Homes that are clean, updated, and in great condition often sell at a higher price. Buyers are willing to pay a premium for a home that's move-in ready, especially since they likely won't have the budget for post-purchase improvements. Addressing cosmetic issues or minor repairs before listing helps you avoid buyers nitpicking during negotiations, allowing you to keep more money in your pocket.

Time is another major factor. Homes that are well-prepared tend to sell faster. When your home looks its best, it attracts more attention from serious buyers, making it less likely to sit on the market. A home that lingers too long may eventually require price reductions, cutting into your profit. Preparing your home upfront ensures you're setting yourself up for success from day one.

Buyers also form opinions quickly, often within minutes of stepping inside a home. A staged, clean, and well-maintained property makes a strong first impression, creating an emotional connection that motivates offers. Plus, addressing potential issues before the inspection can prevent last-minute surprises that might delay or derail the sale.

In today's competitive market, a well-prepared home also appeals to a broader pool of buyers. Neutral d?cor and a fresh, polished look allow buyers to envision themselves in the space, making it easier for them to say yes. This broader appeal not only helps your home sell faster but also reduces the likelihood of complicated contingencies.

Preparing your home may take some extra time and effort, but the payoff is worth it. To maximize your home's value and ensure a smooth sale, schedule a pre-listing prep consultation with your real estate agent. They can guide you on which updates will deliver the highest return and help position your home to attract today's buyers. A little preparation now can make all the difference when it's time to sell.

April 2nd, 2025

As home prices and mortgage rates rise, buyers are looking for innovative ways to make homeownership more manageable. One option gaining popularity is the Accessory Dwelling Unit (ADU).

An ADU is an independent living space, often resembling a small apartment or efficiency, located on the same property as a single-family home. It can be attached to the main house, like a basement or garage conversion, or it can stand alone as a detached structure. While not widely known, ADUs offer unique financial and lifestyle benefits that could make homeownership more affordable.

The most significant advantage of an ADU is the potential to generate rental income. By renting out the ADU, buyers can offset their monthly mortgage payments, making homeownership much more attainable.

This can be particularly helpful for first-time buyers or those with moderate incomes who may otherwise struggle to afford a home. Even beyond rental income, ADUs serve as a long-term investment, adding value to the property and increasing its appeal for future buyers.

ADUs aren't just for young buyers, though?they're a versatile solution for various lifestyles. Retirees, for example, can generate extra income by renting out the ADU or even maximize their financial potential by moving into the ADU themselves and leasing out the main house.

Families can use ADUs to keep aging parents close while maintaining privacy, and empty-nesters who love to travel can rent out both the main house and ADU seasonally, creating an additional income stream.

While there are challenges to adding an ADU, such as navigating zoning regulations or securing financing, the rewards can far outweigh the initial effort. An ADU can make your property more affordable, generate passive income, and become a valuable investment over time.

If this idea sparks your interest, talk to your real estate agent to explore whether an ADU could work for you. It's a creative and practical solution that could open the door to homeownership in today's competitive market.

March 24th, 2025

For homeowners with mortgages, rising insurance premiums pose a unique and unavoidable challenge. Unlike those who own their homes outright, mortgage holders are required by their lenders to maintain adequate homeowners insurance. This ensures that the lender's investment in the property is protected in the event of a disaster, but it leaves homeowners with little choice but to absorb the increasing costs.

Between 2020 and 2023, insurance premiums surged by about 20%, and in some high-risk areas, the increases are even steeper. For many, this spike has strained household budgets, adding to the already heavy financial burden of rising interest rates, property taxes, and maintenance costs.

Several factors contribute to these rising costs:

- Climate Change: The increasing frequency and severity of natural disasters, such as hurricanes and wildfires, have resulted in higher claims, prompting insurers to raise premiums or withdraw from high-risk markets.

- Construction Costs: Between 2020 and 2023, construction input prices rose by 37.7%, with machinery costs increasing by 12% from 2022 to 2023, leading to more expensive claims for insurers.

- Regulatory Challenges: In some states, regulatory environments have hindered insurers' ability to adjust rates in line with escalating risks, causing some companies to exit these markets.

Unfortunately, dropping coverage isn't an option for mortgage holders. If a homeowner fails to maintain adequate insurance, the lender may purchase a policy on their behalf?often at a much higher cost?adding it to the homeowner's monthly mortgage payment. This arrangement, known as "force-placed insurance," typically provides less coverage at a premium rate, compounding the financial strain.

What Can Homeowners Do?

Homeowners feeling the squeeze have several strategies to mitigate the impact of rising insurance costs:

- Shop Around: Compare policies from multiple insurers to find the most competitive rates.

- Bundle Policies: Many companies offer discounts for bundling home and auto insurance.

- Increase Deductibles: Opting for a higher deductible can lower monthly premiums, though it means paying more out-of-pocket for claims.

- Explore State Programs: In some states, government-backed insurance programs may offer affordable options for high-risk homeowners.

A Call for Broader Solutions

While individual strategies can help, the broader affordability crisis requires systemic solutions. Climate change mitigation, regulatory reforms to stabilize insurance markets, and efforts to control construction costs are all critical to easing the financial burden on homeowners.

If you're buying a home or already dealing with the strain of rising insurance costs, reach out to your insurance agent or lender to review your options, stay compliant with mortgage requirements, and safeguard your home and financial well-being.

March 17, 2025

Getting pre-approved for a mortgage is a vital step in the homebuying process. While many buyers rely on online calculators or their first pre-approval offer, these tools and initial approvals might not always provide the best options. If you're serious about making a smart financial decision, seeking a second opinion from a trusted mortgage officer is a step worth taking.

Why a Second Opinion Matters

Your first pre-approval might feel like a green light to move forward, but it's important to remember that not all lenders offer the same terms. A second opinion could uncover better interest rates, saving you thousands of dollars over the life of your loan. Additionally, it might provide access to unique loan programs tailored to your financial needs or even reveal ways to reduce upfront fees.

Benefits Beyond the Numbers

Working with a second mortgage officer can also lead to better service. A recommended professional often offers personalized guidance, quicker closing times, and local market-specific expertise. These advantages not only ease the stress of buying a home but can also make you a stronger contender in competitive markets.

Flexibility and Peace of Mind

Sometimes, a second lender may offer greater flexibility with credit scores or loan terms. This can be especially valuable if your financial situation isn't straightforward. Ultimately, knowing you've explored all your options gives you confidence that you've secured the best deal possible.

Addressing Concerns About Credit Scores

Many buyers worry that seeking a second opinion could negatively impact their credit score due to an additional inquiry. However, credit bureaus treat multiple mortgage inquiries within a short time frame?usually 14-45 days?as a single inquiry, so your score is unlikely to be affected. Additionally, the costs associated with getting a second opinion are often minimal or negligible, especially when compared to the potential savings from better rates, lower fees, or improved loan terms. Taking this step is a low-risk, high-reward move that ensures you're making the most informed financial decision.

Take the Next Step

Choosing the right mortgage is just as important as choosing the right home. Don't settle for the first pre-approval without ensuring it's the best fit for you. Ask your real estate agent for a recommendation of a trusted mortgage officer who can provide you with a thorough and professional second opinion. It's a simple step that could make a significant difference in your home buying journey!

March 11, 2025

When interviewing real estate agents to sell your home, asking the right questions is key to finding an agent who will best meet your needs. The process of selling a home can be complex, and the right agent will not only have the experience and market knowledge but also the right approach to guide you through every step.

By asking insightful questions, you can gauge an agent's expertise, communication style, and understanding of your goals, ultimately helping you choose someone who will work tirelessly to achieve the best possible outcome for you.

Here are 25 common questions homeowners often ask when interviewing a real estate agent to sell their home:

- What is your experience in real estate, and how long have you been working in this area?

- How many homes have you sold in the past year?

- What is your average sale-to-list price ratio?

- How familiar are you with my neighborhood?

- How do you determine the listing price for a home?

- What are the current market trends, and how will they impact my home's sale?

- Can you provide references from past clients?

- What is your marketing strategy to sell my home?

- Do you use professional photography, staging, or virtual tours?

- Will you host open houses? If so, how many and when?

- How will you keep me updated throughout the selling process?

- What online platforms and social media channels will you use to promote my home?

- What do you think are the unique selling points of my home?

- How do you handle multiple offers?

- What is your strategy for negotiating the best price for my home?

- What is your commission rate, and what services does that include?

- Are there any additional fees I should be aware of?

- What steps do I need to take to prepare my home for sale?

- How long do you expect it will take to sell my home?

- What challenges do you anticipate in selling my home?

- Can you provide a comparative market analysis (CMA) for my home?

- How do you handle a situation where my home isn't getting offers?

- What happens if I'm not satisfied with your service? Can I cancel the contract?

- Do you work alone, or do you have a team?

- What sets you apart from other agents? Why should I choose you?

Answers to these questions will help homeowners understand an agent's expertise, marketing approach, negotiation skills, and overall fit with their needs. For more information, download our Sellers Guide.

March 3rd, 2025

In the past, many homeowners didn't give much thought to keeping detailed records of home improvements. With capital gains exclusion thresholds of $250,000 for single filers and $500,000 for married couples, most homeowners didn't come close to exceeding these limits when selling their homes.

As a result, they often overlooked the importance of tracking and documenting their expenditures on property improvements. However, the landscape has shifted significantly in the last decade.

The rapid appreciation of home values has pushed many homeowners into a position where they might exceed the capital gains exclusion threshold and owe taxes on their profit. By understanding what qualifies as a capital improvement and maintaining accurate records, homeowners can increase their adjusted basis, thereby reducing their taxable gain when selling their property.

What Counts as Capital Improvements?

Capital improvements are expenditures that add value to your home, prolong its useful life, or adapt it to new uses. These are not limited to big-ticket items like kitchen remodels or room additions, installing energy-efficient windows, replacing a roof, or upgrading HVAC systems.

Even landscaping improvements, building a deck, or adding a fence can qualify, as well as replacing a faucet, adding a video doorbell or other smart devices in the home. The key is that these improvements must be permanent and add to the property's value.

Why Keeping Records Matters

Every dollar spent on a capital improvement adds to the cost basis of your home. The cost basis is used to calculate your capital gain, which is the difference between your home's net sale price and its adjusted basis (original purchase price plus improvements). By increasing your cost basis, you can reduce the taxable portion of your profit, potentially saving thousands of dollars in capital gains taxes.

To maximize these benefits, it's crucial to keep receipts, invoices, and other documentation for all qualifying expenditures. Create a folder—physical or digital—to organize these records and ensure they're readily available when it comes time to sell your home.

Why This Matters Now

In the last decade, home prices have appreciated at an unprecedented pace. Inventories are smaller and demand is high causing the prices to increase. This rapid growth means more homeowners may find themselves exceeding the capital gains exclusion thresholds.

By properly documenting capital improvements, homeowners can mitigate their tax burden and retain more of their hard-earned equity. As home prices continue to rise, understanding and utilizing these strategies has never been more important.

For more information, consult your tax professional and download our Homeowners Tax Guide or IRS Publication 523.

February 17th, 2025

In today's fast-paced real estate market, homeowners are increasingly considering alternative selling methods. One option gaining traction is selling to an iBuyer company. These tech-driven real estate firms offer a quick, streamlined process for homeowners looking to sell their properties. But like any major financial decision, selling to an iBuyer comes with its own set of advantages and disadvantages. Let's explore the key factors to consider when weighing this modern selling approach against traditional methods.

Pros of Selling to an iBuyer

Speed and Convenience - iBuyers have revolutionized the selling process by offering remarkably fast transactions, often closing within 10-14 days. This rapid turnaround is a game-changer for sellers who need to relocate quickly or want to avoid the prolonged process of traditional home selling. It's particularly appealing for those facing time-sensitive situations like job transfers or family emergencies.

Simplified Process - The iBuyer model has transformed the home selling experience into a predominantly online transaction. This digital approach eliminates the need for time-consuming tasks such as staging, hosting open houses, and accommodating multiple showings. For sellers who value privacy or have hectic schedules, this streamlined process can be a significant relief, allowing them to sell their home with minimal disruption to their daily lives.

Cash Offers - One of the most attractive features of iBuyers is their ability to make all-cash offers. This financial flexibility can be a crucial advantage for sellers who need immediate liquidity or are looking to make a contingency-free offer on their next home. Cash offers also typically mean faster closings and fewer potential complications, providing sellers with a higher degree of certainty in their transactions.

As-Is Purchase - iBuyers often purchase homes in their current condition, without requiring sellers to make repairs or upgrades. This feature can be particularly beneficial for homeowners with properties in less-than-perfect condition or those who lack the time or resources to prepare their home for traditional market listing. It allows sellers to avoid the stress and expense of pre-sale renovations, which can be substantial in some cases.

Cons of Selling to an iBuyer

Lower Sale Price - While iBuyers offer convenience, it often comes at a cost. These companies typically offer below-market prices for homes, with sellers potentially receiving less than they might through traditional methods. This pricing strategy allows iBuyers to quickly resell properties for a profit, but it means sellers may be leaving money on the table. In hot markets or for unique properties, this difference could be even more significant.

Higher Fees - The convenience of iBuyer services often comes with higher transaction fees compared to traditional real estate commissions. These fees can reach up to 13% of the home's price, significantly eating into the seller's proceeds. While traditional real estate commissions typically range much less, iBuyer fees encompass various services and risk factors, resulting in a higher overall cost to the seller.

Limited Negotiation - iBuyers rely heavily on computerized models to determine offer prices, leaving little room for negotiation. This approach means sellers are often presented with a take-it-or-leave-it offer, unlike in traditional sales where there's often back-and-forth between buyers and sellers. For homeowners who believe their property has unique value or features that an algorithm might not capture, this lack of flexibility can be frustrating.

Lack of Representation - When selling to an iBuyer, homeowners forgo the personalized guidance and local market expertise that comes with working with a real estate agent. While this might appeal to some, others may miss the nuanced advice and emotional support that an experienced agent can provide throughout the selling process. This lack of personal interaction and the fiduciary relationship with an agent can be particularly challenging for first-time sellers or those dealing with complex property situations.

Availability Limitations - iBuyer services are not universally available and often have specific criteria for the homes they purchase. This limitation means that many homeowners, particularly those in rural areas or with unique properties, may not have access to this selling option. Additionally, iBuyers typically focus on homes within certain price ranges and conditions, further restricting their availability to a subset of the market.

While selling to an iBuyer offers undeniable convenience in terms of time and effort, it's crucial for homeowners to recognize the financial trade-offs involved. The streamlined process and quick closing can be attractive, especially for those in time-sensitive situations.

However, the convenience often comes at the cost of a discounted sale price, potentially resulting in sellers not realizing the maximum equity from their homes. Homeowners must carefully weigh the value of a faster, easier sale against the possibility of a higher return through traditional methods.

Ultimately, the decision should align with the seller's specific circumstances, financial goals, and market conditions. For those prioritizing top dollar over speed, working with a skilled real estate agent to navigate the traditional market might be the better choice to maximize their home's value.

February 10, 2025

During crises, whether natural or personal, the risk of scams and fraud increases. While many organizations can assist you with financial difficulties or foreclosure, it's crucial to ensure you're dealing with a reputable entity before proceeding.

Always research any unsolicited offers for help. Protect yourself by asking questions, thoroughly reviewing provided materials, and avoiding solicitations that demand upfront payments.

- A company/person asks for a fee in advance to work with your mortgage company to modify, refinance or reinstate your mortgage.

- A company/person guarantees they can stop foreclosures or get your loan modified.

- A company/person advises you to stop paying your mortgage company and pay them instead.

- A company pressures you to sign over the deed to your home or sign any paperwork that you haven't had a chance to read, and you don't fully understand.

- A company other than your mortgage company claims to offer "government-approved" or "official government" loan modifications.

- A company/person you don't know asks you to release personal financial information online or over the phone.

Here are some common predatory scams and other potential traps to watch out for:

- "Call spoofing" scams: Caller ID or phone "spoofing" occurs when a caller deliberately falsifies the information transmitted to your caller ID in an effort to disguise their identity while pretending to be someone else ... often in order to get you to share your personal information over the phone. Learn more.

- Foreclosure rescue fraud: In this scheme, someone may offer false promises of being able to save your home from foreclosure or guarantee a loan modification with a reduced mortgage payment. Learn more.

- Title scams: When someone offers to give you a loan or fast cash in exchange for taking over your mortgage and title. They may allow you to remain in your home as a renter and promise you that you can buy the home back once you are on your feet, but once the deed is transferred, there's no guarantee that you'll ever own the home again.

- Post-disaster insurance scams: In the wake of a disaster, someone may offer you money immediately in exchange for money you will get later from the insurance company. You end up getting much less from the individual than the insurance company actually would have paid you or your home repair contractors directly.

If you suspect you are a victim of mortgage fraud or spoofing scams against your home, you should contact the Federal Trade Commission (FTC), your local police department, and the FBI's Internet Crime Complaint Center (IC3), or call 1-888-995?HOPE (4673) to report it immediately.

February 6, 2025

The spring season presents a unique opportunity for savvy homebuyers to get ahead in the market. While many are waiting on the sidelines for rates to drop, those who act now can reap significant benefits.

Recent market trends show that inventory levels and new listings have increased, offering a wider selection of homes for buyers. This temporary lull in competition means you have more negotiating power and time to find your perfect home without the pressure of bidding wars.

By purchasing now, you're not just securing a home; you're making a smart investment. Even if current mortgage rates are slightly higher, you're locking in today's home prices before they potentially rise more. Remember, you can always refinance when rates decrease, but you can't go back in time to buy at today's prices.

Moreover, by acting now, you'll be settled into your new home while others are still waiting and watching. You'll have the advantage of enjoying your space, building equity, and potentially benefiting from any market upswings.

Don't let this opportunity pass you by. The best time to buy a home is when you're ready, and the current market conditions are favorable for those willing to make a move. Secure your future today and get ahead of the crowd ... your dream home is waiting!

While the seasonal trends in real estate are important to consider, recent market developments have added another layer of complexity to the homebuying landscape.

In late August and early September, we saw a sudden improvement in mortgage rates, which prompted many buyers who had been waiting on the sidelines to re-enter the market. This surge in activity was immediate and significant, demonstrating the pent-up demand that exists among potential homebuyers.

September brought some positive news, with Realtor.com's "Monthly Housing Market Trends Report" showing increased inventory levels and more new listings year-over-year. However, this optimism was short-lived. October saw a sharp decline in new listings month-over-month, and the average time homes spent on the market increased to nearly two months ... the slowest October in five years.

The spike in rates during October caused many buyers to retreat once again. As a result, market activity slowed considerably, with homes staying on the market longer and inventory levels rising.

These recent fluctuations underscore the importance of being prepared and ready to act when market conditions are favorable. While waiting for the perfect moment, you might miss out on opportunities. Remember, you can always refinance your mortgage in the future if rates improve, but you can't go back in time to purchase at today's prices if they continue to rise.

For those considering buying a home, it's crucial to work with a knowledgeable real estate professional who can help you navigate these market dynamics and identify the best opportunities, regardless of the season or current rate environment.

Download the Homeownership Today report that presents a case that acting now may be better than waiting.

April 5, 2024

A good listing agent will maximize your proceeds of sales so that you realize the most from your equity.

April 4, 2024

The ultimate goal isn't merely to "search" for your dream home but to actively find it, and that's where a skilled agent's expertise is truly valuable.

April 3, 2024

Homeowners, it's time to pocket those profits! Contact me to find out what your home is worth.

April 2, 2024

Is your home feeling like more than you can manage in your current stage of life? It might be time to think about downsizing. ?

March 29, 2024

The new normal for mortgage rates now hovers around the 6% range and it's increasingly less likely for mortgage rates to return to previous lows below 5%.

March 28, 2024

Providers hold significant value due to their industry expertise, extensive network, and first-hand experience working with various professionals.

March 27, 2024

Your agent can supply recent comparable sales and other information to help you make a reasonable offer.

March 26, 2024

If you refer your agent to someone, let them know so they can follow-up.

March 25, 2024

Your real estate professional can help you understand the differences and provide you with information applicable to the current market.

March 11, 2024

This is a great way to help out a family member to get in a home today, especially if they're going to inherit it in the future anyway. You get to see them enjoy it.

March 8, 2024

A good listing agent will present a balanced assessment of the price and terms of an offer for you to make an informed decision.

March 7, 2024

Protect yourself from being scammed by a moving company - www.ProtectYourMove.gov.

March 5, 2024

Here are a few tips to keep cut flowers fresh longer: ?

?

Start with a clean vase. Use diluted bleach and give your vase a good scrub to get rid of any bacteria before you add your arrangement. ?

?

Add flower food. If you don’t have any on hand, you can provide nutrients by mixing 2 tbs lemon juice, 1 tbs sugar, and 1/2 tsp bleach into your vase water. ?

?

Snip stems and remove leaves. Cut stems at a 45-degree angle and remove any leaves that will be submerged. This prevents bacterial growth and aids water and nutrient absorption. ?

?

Replace water and recut stems. Trim stems every 3-5 days and add fresh water daily to keep the vase clean and flowers hydrated. ?

?

Avoid heat and direct sunlight. Watch for overexposure, which can dry out flowers prematurely. ?

March 4, 2024

Check with your insurance agent before you leave the home vacant.

March 1, 2024

Borrowers with compensating factors may be able to qualify with a higher debt-to-income ratio.

February 29, 2024

Homeownership is an excellent hedge against inflation and a great wealth builder.

February 28, 2024

In 2024, maximalism is in. That means bold hues, eclectic artwork, and contrasting textures and patterns. ?

?

While this look can be a great way to embrace your personal style, it could deter potential buyers if you aren’t careful. ?

?

Here are some do’s and don’ts if you are selling your home: ?

?

Do: Balance statement pieces with a more neutral paint palette ?

Don’t: Cover walls in polarizing shades, like bright pink ?

Do: Try patterned wallpaper in a small room, like a powder room ?

Don’t: Cover a large space in a too-bold or busy print ?

Do: Curate the belongings you display ?

Don’t: Allow your home to become cluttered or overly personalized

?

February 27, 2024

If you are considering selling, these conditions favor higher prices and lower competition. Call me to find out more.

February 23, 2024

Let's visit to talk about how to coordinate the move.

February 22, 2024

Depending solely on Internet sources for information is like hearing the news from one source and expecting to gain a balanced, accurate understanding of current events.

February 22, 2024

Mixing the metal finishes on fixtures and hardware used to be tacky. But in 2024, it’s on trend. ?

?

Here are our top tips to help you embrace this look like a design pro: ?

?

Choose metals with bold contrast, like satin nickel and polished brass. ?

Avoid near matches like gold and bronze, which can look accidental rather than intentional. ?

Use each metal at least two times in a room for an intentional, sophisticated look. ?

Stick to two metals in a small room, and two to three in a larger space. ?

Swap your matte finishes for trendy, high-polish details.

February 20, 2024

Higher mortgage rates have slowed down the real estate market. But there will always be home buyers and sellers who need to move because of life circumstances. ?

?

Some industry pros refer to these as the 5 D's: ?

?

Diamonds: Couples getting married or moving in together often seek out new or larger homes. ?

?

Diapers: Growing families typically need more space. ?

Divorce: Unfortunately, divorces often make home sales necessary. ?

Downsizing: Empty nesters might choose to move into a smaller home. ?

Death: Sadly, the death of a homeowner is another common reason for home sales. ?

?

Whatever your reason for moving, we can help! Reach out to schedule a complimentary appointment to discuss your goals. ?

February 19, 2024

Have an open and candid conversation with your insurance agent. There is a difference in replacement cost value and market value.

February 16, 2024

Absolutely, one of the best things you can do financially.

February 14, 2024

Wishing you a Valentine's Day filled with love and the perfect home to match!

February 12, 2024

Talk to your agent to better understand the reasoning behind this.

February 9, 2024

Your agent can help you put together a winning team.

February 8, 2024

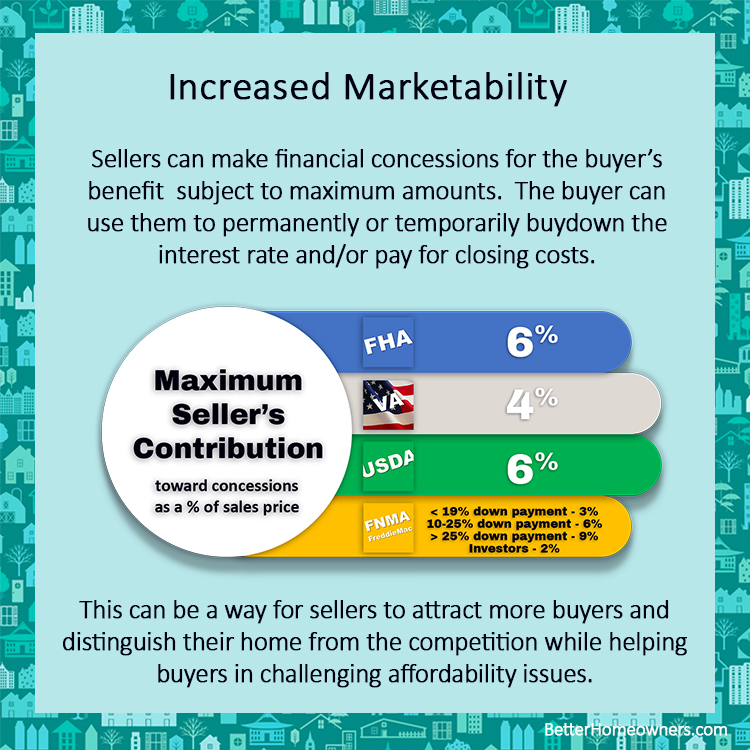

In some cases, it may be possible to negotiate with the seller to pay part of the buyer's closing costs but every seller is a unique situation based on the other terms of the contract.

February 5, 2024

Getting into a home, even if it isn't your "forever" home can be your best investment and protection against inflation.

February 2, 2024

Happy Groundhog Day...Regardless of whether you're selling or not, contact your agent to get a much more accurate value for your home in today's market.

February 1, 2024

There may be eyes (and ears) watching you when you're house hunting so keep your comments neutral until you are alone in the car.

February 1, 2024

Have you ever thought about buying a foreclosed home? ?

?

Foreclosures are often sold below market value, so you can save significantly on the initial purchase. However, they can end up costing more in the long run if they require costly repairs. ?

?

Here are 3 things to consider before you decide: ?

Foreclosures are typically sold as-is, meaning the seller bears no liability for any problems. ?

You may be unable to tour the home or have an inspection before purchasing. ?

Foreclosed homes often need extensive repairs due to long-term vacancy or neglect. ?

?

Buying a foreclosure can be both risky and rewarding. Reach out to discuss all the options available in our market so we can help you make an informed decision and score a great deal. ?

January 29, 2024

This can be a great opportunity for Veteran's spouses who meet one of these requirements.

January 26, 2024

The best plan is always to get pre-approved and I can recommend a mortgage officer who specializes in FHA loans.

January 25, 2024

If you have any questions about your home insurance policy, ask your insurance agent.

January 25, 2024

Last year was a tough one for U.S. home buyers. But the year ahead is looking brighter! ? ?

?

?? Mortgage rates should finally be headed down. ?

Lower rates will go a long way toward making homeownership more affordable. ?

?

?? Record-high price appreciation has slowed. ?

The crazy price hikes are over; home values should remain relatively stable in 2024. ?

?

?? Lower demand is giving buyers more bargaining power. ?

With fewer buyers making offers, there's more incentive for sellers to negotiate. ?

?

Check out our latest blog post to learn how buyers can make the most of the 2024 real estate market! ?

January 22, 2024

ARMs can lead to even lower monthly payments making them attractive to budget-conscious buyers.

January 19, 2024

Interest rates are the current cost of doing business and can be refinanced when appropriate but waiting for lower rates could cost you in the form of higher purchase prices due to appreciation.

January 18, 2024

The income from the other units lowers the contribution to the payment for you and is an investment for the future.

January 12, 2024

Please consider me your go-to source for anything real estate; I'm here to help even when you're not buying or selling.

January 11, 2024

The good news is rates are coming down and you'll have lower payments than just a month ago.

January 9, 2024

Making New Year’s resolutions? Add these items to the list to make the most of your home in 2024. ?

?

Declutter and organize. ?

Go through one room each month and discard or donate items you no longer use. ?

Stay on top of maintenance. ?

Add recurring tasks to your calendar to ensure you stay on track. ?

Cut down on energy use. ?

Schedule an energy audit to identify leaks and upgrade to more efficient appliances. ?

Invest in home security. ?

Install a monitored security system and upgrade your outdoor lighting. ?

Freshen up your space. ?

Add some new throw pillows or swap dated light fixtures for more modern alternatives. ?

?

Need professional help getting your home ready for the year ahead? Reach out for a referral! ?

January 8, 2024

Look for an agent who exhibits high levels of education and experience who will devote the effort to find your home.

January 5, 2024

Rely on your agent's expertise to uncover hidden sources and make your homeownership dreams a reality!

January 4, 2024

We're ready to listen to what you want and go to work to find it.

January 1, 2024

We'd like to be of help to you if plans for the new year include buying or selling a home or even advice on any real estate questions you may have.

December 29, 2023

Reach out and we can get together virtually or in person to talk.

December 28, 2024

Homeownership offers stability, fixed payments, and longer generational wealth, not to mention personal satisfaction, pride of ownership, and a safe, secure place to live.

December 25, 2023

Our team hopes that you enjoy your family and holidays.

December 22, 2023

Appreciation and amortization have a big impact on your equity but leverage of high loan-to-value mortgages for homeowners also plays a big part.

December 21, 2023

Getting into a home, even if it isn't your "forever" home can be your best investment and protection against inflation.

December 19, 2023

Thinking about building a new home? ?

?

With a shortage of existing homes on the market, new construction can be a compelling option. ?

?

If you answer “YES” to these five questions, a new build might be right for you. ?

?

If you’re on the fence, reach out for a free consultation. We can help you decide whether a new or existing home is right for you—and help you with your purchase no matter what you choose. ?

December 18, 2023

A property description is a marketing tool, a home inspection is a reality check, and a home warranty is a safety net.

December 15, 2023

I want to help not only when you buy and sell, but all the years in between.

December 14, 2023

Homes that need cosmetic improvements are often priced lower than homes that are move-in ready.

December 11, 2023

There really is a lot more to finding the right home than just searching online. Let's get together and I share my plan with you.

December 8, 2023

We want to be your trusted agent, ready to support you find your dream home as you start this new chapter in your life.

December 7, 2023

As an owner-occupant, you are eligible for low downpayment mortgages.

December 4, 2023

It isn't magic; it's the power of the home's appreciation and amortization, neither of which benefit renters

Check out my newsletter!

December 1, 2023

The persistently low inventory has driven up home prices this year and is expected to pose a continued challenge for those waiting for better interest rates in the future.

November 30, 2023

Working with an agent proficient in every aspect of the transaction ensures a smooth and confident home buying experience, putting your best interests at the forefront.

November 27, 2023

Think of it like fine-tuning a radio station: if you're not hitting the right 'frequency' with buyers, it might be time for a price adjustment to tune in to the perfect harmony!

November 25, 2023

The "right" agent will help you with everything that has to be done to sell your home fast and for the best price.

November 24, 2023

Only real estate agents can add properties to the Multiple Listing Service (MLS) — and there are major benefits to having your home listed.

Visibility to buyer’s agents.

Since the MLS includes more detailed and up-to-date information than online aggregators like Zillow, real estate agents use it to find potential homes for their clients.

More qualified potential buyers.

Because the MLS is used by buyer’s agents, you’re more likely to draw in serious shoppers — not just curious onlookers.

Placement on more listing websites.

MLS listings are automatically syndicated on hundreds of real estate websites, which means greater exposure for your home.

If you work with us to sell your home, we’ll place your listing on the MLS, but that’s only the start of our marketing efforts. Reach out for a copy of our multi-step property marketing plan or to schedule a free consultation.

November 23, 2023

If you think you may have been a victim of a mortgage relief scam, you should contact your state attorney general's office or the Federal Trade Commission (FTC).

November 22, 2023

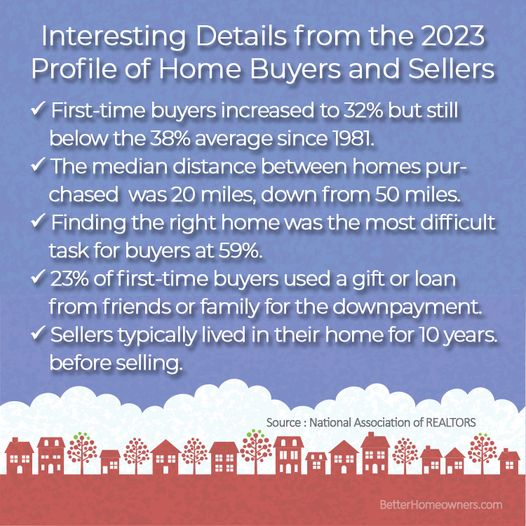

The complete report was just released last week and contains 141 pages giving valuable insight into trends and services buyers and sellers consider valuable.

November 21, 2023

More excitement is ahead!

November 20, 2023

Every paw-spective buyer may not feel the same way you do about pets.

November 17, 2023

If nothing else, have a discussion with your insurance agent a couple of months before the anniversary date.

November 16, 2023

As your REALTOR®, it's not just about finding the perfect house; it's about finding the perfect match!

November 13, 2023

Let's get together and talk about it.

November 10, 2023

Using their benefits to turn the key, because heroes deserve a welcoming hearth.

November 9, 2023

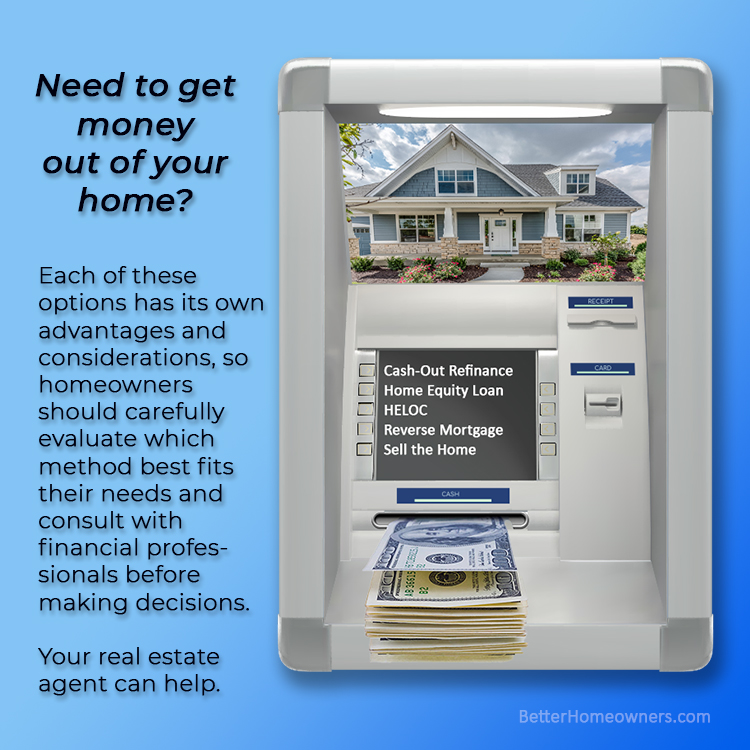

Maybe you've never thought of your home as an ATM but it is a valuable asset that provides options to homeowners.

November 6, 2023

With the increase in conventional conforming loan limits, your dream home might be closer than you think.

November 3, 2023

Leverage your negotiations to their fullest potential by relying on your agent's expertise to suggest alternatives

November 2, 2023

A skilled agent can coordinate the intricacies of both transactions, guaranteeing a seamless and timely process.

October 31, 2023

To keep our children safe, be extra careful driving through the neighborhoods.

October 27, 2023

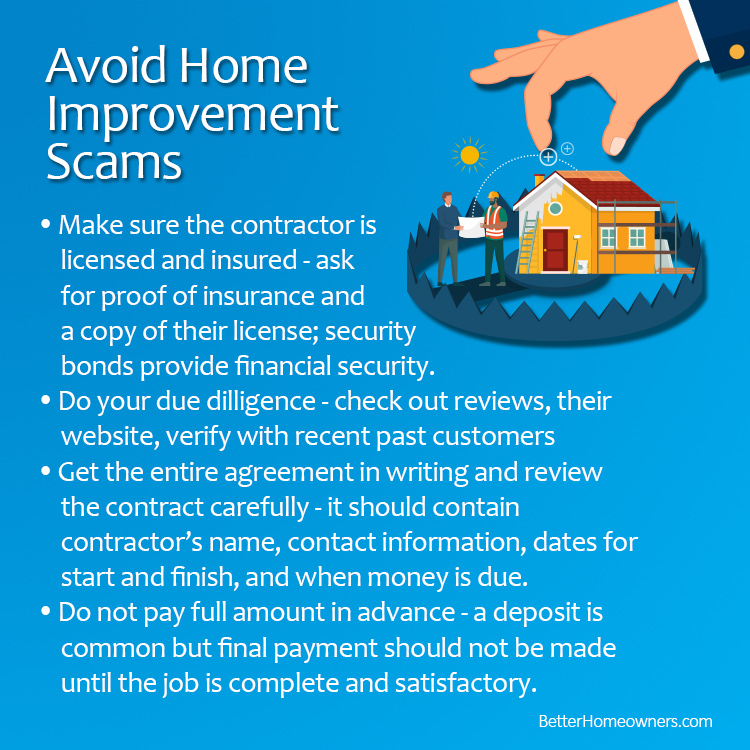

Ask your friends if they have a recommendation for the type of contractor you need. You can also ask your agent to give you recommendations.

October 26, 2023

When you rent, you are paying for the landlord's mortgage, property taxes, and maintenance costs. When you buy, you are paying for those things plus your own equity.

October 23, 2023

October 20, 2023

Your real estate agent should be able to provide you with up-to-date information about the local market.

October 19, 2023

Your agent will be there with you every step of the way and we provide a Buyer's Guide at our first meeting.

October 16, 2023

Contact me for an information guide explaining what you need to know.

October 13, 2023

On meeting with buyers for the first time, we explain the entire process of buying a home, what is normal, and what exceptions are possible.

October 12, 2023

Let your agent be your guide through the real estate maze, translating jargon into your own home-buying success story!

October 9, 2023

Don't let high mortgage rates slow down your homeownership dreams! Contact your agent today to explore these options together!

October 6, 2023

Don't let water sneak in and wreak havoc! Seal the deal against damage by taking simple steps to protect your home from watery woes.

October 5, 2023

Your listing agent can provide more details on how to implement this strategy.

October 2, 2023

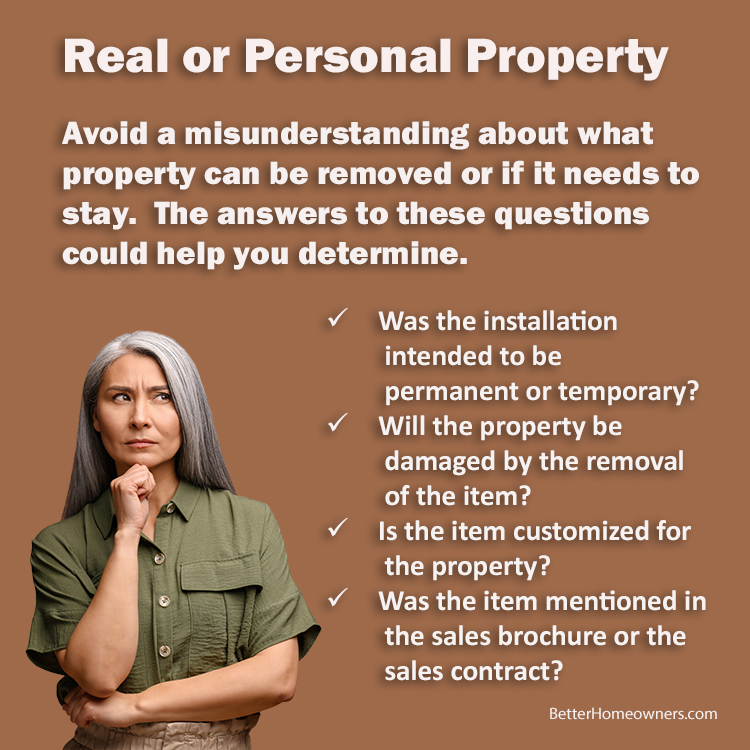

When in doubt, let your agent sort it out! Your trusted advisor is here to help you distinguish real from personal property and guide you to a seamless sale.

September 29, 2023

Only one person will end up buying your home and it is your agent's job to use all means possible to expose it to the right possible prospects.

September 28, 2023

Let's connect and we check out your numbers to see the difference.

September 27, 2023

Homebuyers should always verify with your agent and another trusted individual like a settlement or mortgage officer that the request for funds is legitimate before transferring money.

September 26, 2023

Unlock the door to your financial future with single-family rental homes - where every house key holds the promise of prosperity!

September 25, 2023

Agents vary in their approach, and we stand out by respecting your time and preferences through thorough research to identify the "right" home for you.

September 22, 2023

Your agent can tell you if properties in the area you want to live are eligible for this type of mortgage.

September 21, 2023

Allow me to assist you in discovering the perfect professional for your upcoming transition.

September 20, 2023

As young people enter the full-time workforce and begin to think about living on their own, it may not seem practical or wise to consider buying a home. However, it may be a pivotal decision for your financial security and future retirement.

Rents are going to increase based on the shortage of rental units needed for the demand of the market. Buying a home is a way to control those costs and even provide income by converting it to a rental as you decide to move up into another home.

There is an advantage to buying a home before a person gets married, starts a family, and has their standard of living at a higher pace. Their expenses are lower, and it is easier to not only qualify for a loan but possibly, take advantage of programs for down payment assistance, grants, or other options like gift funds or co-signers.

Purchasing a home is a significant financial decision, particularly for first-time homebuyers. However, there are several benefits to buying a home early in your career, even if it is not your dream home.

One of the most significant benefits of buying a home as an investment is that it can help you build equity. Equity is the difference between the value of your home and the amount you owe on your mortgage. As your home's value increases, so does your equity. This can be a valuable asset in the future, as you can use it to finance other investments or retirement expenses.

Another benefit of buying a home as an investment is that it can generate passive income. If you rent out a room or two in your home, you can use the rent to help cover your mortgage payments and other expenses. This can free up your disposable income to invest in other areas, such as your retirement savings.

Of course, there are some risks associated with buying a home as an investment. The value of your home may not always increase, and you may have to deal with unexpected expenses, such as repairs or maintenance. However, the potential benefits of homeownership can outweigh the risks, particularly if you are strategic about your investment.

When choosing a home to purchase as an investment, it is important to consider the location. A home in a desirable area that is likely to appreciate in value over time is a wise investment. It is also important to consider the size of the home. A home with three or four bedrooms will be easier to rent than a property with less.

The strategy can be as simple as:

- Buy a house when you enter the workforce and take on paying roommates. Declare the income on your income tax.

- It doesn't have to be the perfect home, but it does need to be a good home in a good area.

- Never sell the home; instead, convert it to a rental when you move up in the near future as your income goes up.

September 19, 2023

Trusted recommendations are the compass guiding you through the maze of choices and also your peace of mind.

September 18, 2023

A home can be the largest investment for many homeowners that contributes greatly to their wealth.

September 15, 2023

These are very commonplace with builders selling their new homes and your agent can explain how these can be done.

September 14, 2023

90% of home buyers opt for a 30-year fixed-rate mortgage.

September 13, 2023

By employing these tips and working closely with your real estate agent, you can increase your chances of securing a favorable offer as a homebuyer.

September 12, 2023

Your agent can run these numbers for you; you may be very surprised.

September 11, 2023

The loss from missed appreciation could far outweigh the additional cost of a higher rate now that could be refinanced later.

September 8, 2023

It can make a big difference whether buyers decide to schedule a showing.

September 7, 2023

Sellers experience the quickest sales for the most money when they align the list price as closely as possible with the expected market and appraised values.

September 6, 2023

The more you know about mortgages, the better equipped you'll be to get the best deal. Your agent could be the first place to start.

September 5, 2023

For more information, go to www.FMSCA.dot.gov/protect-your-move

September 4, 2023

I hope you can take this day to relax and enjoy the fruits of our labor here in the greatest country in the world.

September 1, 2023

Your agent can supply you with the facts and their opinion as well as other experts in the field.

August 31, 2023

There is a ton of great information by the Federal Government on www.ProtectYourMove.com.

August 30, 2023

Contact me to find out specifically what needs to be done to your home to maximize marketability.

August 29, 2023

Your agent should be giving you advice to write an offer that can compete with the possibility of multiple offers.

August 28, 2023

Let's connect and you'll get specifics of how to get involved with this promising alternative to stocks.

August 25, 2023

Even if this isn't what you're looking for, we're ready to help you find your dream home.

August 24, 2023

Another benefit to getting pre-approved is that the mortgage officer can suggest things that could improve your credit score.

August 23, 2023

Please feel free to reach out to me; I want to be your dedicated real estate resource.

August 22, 2023

Your agent can provide you with a broker's price opinion that your tax advisor can use to establish fair market value.

August 21, 2023

Your agent is the source of this information and based on their experience can help you with good decisions.

August 18, 2023

August 17, 2023

August 16, 2023

August 15, 2023

August 13, 2023

August 10, 2023

August 9, 2023

August 8, 2023

August 7, 2023

August 4, 2023

August 3, 2023

August 2, 2023

July 31, 2023

July 30, 2023

July 28, 2023

.jpg)

July 26, 2023

July 24, 2023

July 22, 2023

July 20, 2023

July 17, 2023

July 15, 2023

Lack of availability is affecting our market.

July 13, 2023

Waiting for rates to come down could cost you big time!

July 12, 2023

Here are some tips to sell your home quicker!

July 4, 2023

The TEN steps to close your home!

July 3, 2023

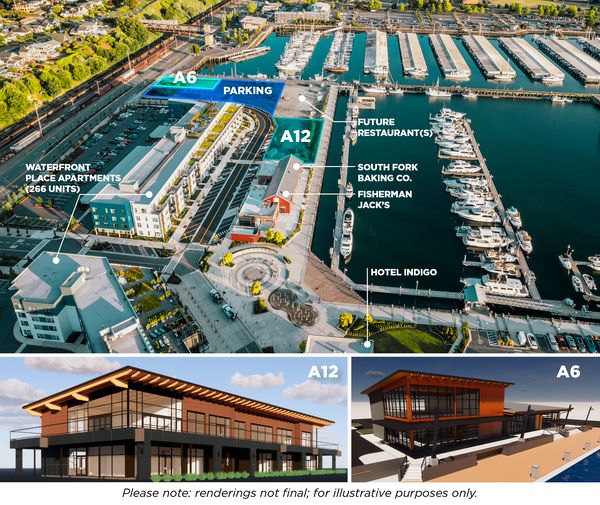

Mukilteo waterfront is an incredible up-and-coming spot!

July 2, 2023

Good agents make it look easy!

July 1, 2023

Get familiar with any discounts that may be applicable to you.

June 30, 2023

Make sure your listing photos are appealing! Staging is an important part of marking a home.

June 29, 2023

Don't wait for interest rates to go down!

June 28, 2023

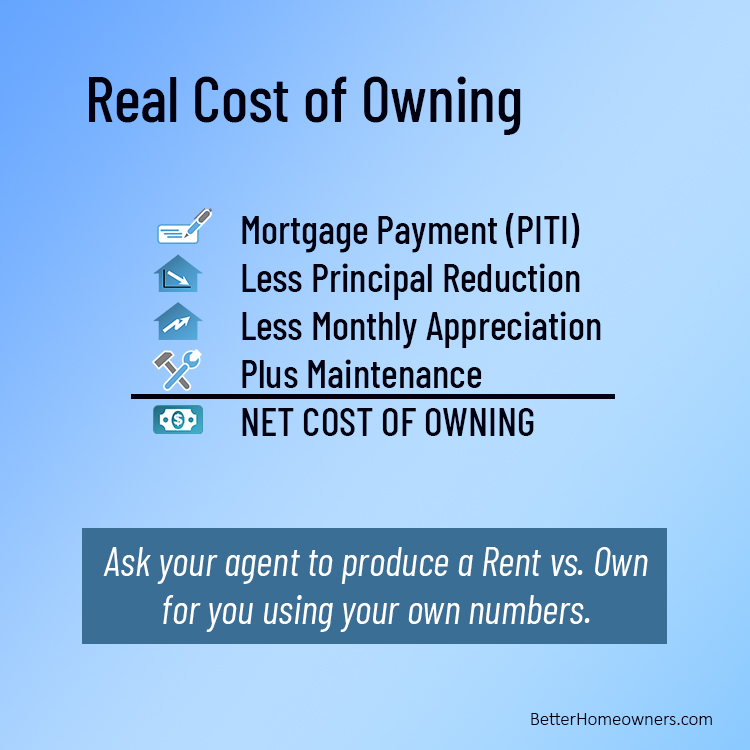

Contact me for a rent vs own calculation using your own figures.

June 27, 2023

When selling a home with a HELOC, the outstanding balance is paid from the proceeds together with your mortgage.

June 26, 2023

Let's connect for a no-obligation opportunity to find you the perfect home this year. Contact me for a complimentary home evaluation today!

What Happens After A Missed Mortgage Payment?

It's unlikely that you've intentionally come to a situation where you're missing a mortgage payment. You might have missed your due date accidentally, or you could be facing financial challenges.

There can be serious consequences that come with a missed mortgage payment, though.

If you're just a few days late, you can still make the payment. After just a few days late, it’s unlikely that it will negatively affect your credit score. Mortgage lenders usually have a 15-day grace period on late payments, but you might have to pay fees.